Commercial Drone Market to Reach USD 65.25 Billion by 2032 Amid Rapid Adoption Across Industries

The commercial drone market size was valued at USD 13.86 billion in 2024 and is projected to grow from USD 17.34 billion in 2025 to USD 65.25 billion by 2032.

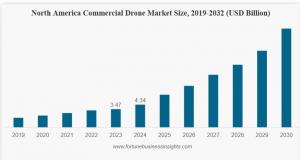

North America dominated the commercial drone market, accounting for 31.31% of the market share in 2024. ”

PUNE, INDIA, February 9, 2026 /EINPresswire.com/ -- According to Fortune Business Insights, the global commercial drone market size was valued at USD 13.86 billion in 2024 and is projected to grow from USD 17.34 billion in 2025 to USD 65.25 billion by 2032, exhibiting a robust CAGR of 20.8% during the forecast period. North America dominated the commercial drone market with a market share of 31.31% in 2024, supported by strong adoption across media, agriculture, logistics, inspection, and mapping industries.— Fortune Business Insights

A commercial drone, also known as an Unmanned Aerial Vehicle (UAV), is a flying device equipped with cameras, sensors, and communication systems that enable autonomous or remotely operated flight. These drones are increasingly being deployed for applications such as surveying, mapping, surveillance, precision agriculture, filming & photography, inspection & maintenance, and delivery & logistics. Growing awareness of commercial drone capabilities and expanding investments in drone startups and technology platforms are expected to further strengthen market growth.

Get a Free Sample Research Report:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/commercial-drone-market-102171

Top Companies in the Commercial Drone Market

• 3D Robotics, Inc. (U.S.)

• Aeronavics Ltd. (New Zealand)

• AeroVironment Inc. (U.S.)

• Autel Robotics (China)

• Ehang Holdings Limited (China)

• FLIR Systems, Inc. (U.S.)

• Teal Drones (U.S.)

• Holy Stone (China)

• Intel Corporation (U.S.)

• AgEagle Aerial Systems Inc. (U.S.)

• Parrot Group (France)

• PrecisionHawk, Inc. (U.S.)

Commercial Drone Market Overview

The commercial drone industry represents a fast-evolving ecosystem of hardware, software, and services supporting aerial data acquisition and automated operations. Continuous innovation in propulsion systems, sensors, AI-enabled analytics, and flight control software has transformed drones into reliable tools for industrial and enterprise use. The market remains highly competitive, with manufacturers focusing on developing lightweight, high-endurance, and intelligent UAVs tailored for specific applications.

Market growth is largely attributed to increasing demand for drones in cargo and logistics operations, infrastructure inspection, and precision farming. Additionally, the COVID-19 pandemic accelerated drone adoption for medical supply delivery, surveillance, and emergency response, resulting in higher-than-anticipated demand compared to pre-pandemic levels.

Speak to Analyst:

https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/commercial-drone-market-102171

Commercial Drone Market Trends

Integration of Artificial Intelligence (AI) is a major trend reshaping the market. AI-enabled drones can process large volumes of data, perform real-time analytics, and enable autonomous decision-making. Advancements in processors, microcontrollers, cameras, and onboard computing systems are enhancing drone performance and reliability.

Another key trend is the growing adoption of Ground Control Point (GCP)-based tools and advanced mapping software, enabling accurate distance, volume, and area measurements. OEM upgrades and sensor innovations are expected to play a crucial role in driving market growth in the coming years.

Commercial Drone Market Growth Factors

• Increasing adoption of small UAVs for filmmaking, agriculture, inspection, and surveillance

• Rising demand for drones in logistics and e-commerce delivery

• Growth in oil & gas, energy, and infrastructure inspection activities

• Advancements in remote sensing and ADS-B transponder technologies

• Expanding development of electric vertical takeoff and landing (eVTOL) aircraft

Major logistics companies and e-commerce players are heavily investing in drone delivery platforms to support fast and efficient last-mile delivery, further accelerating market expansion.

Commercial Drone Market Segmentation Analysis

By Weight

• <2 Kg: Held the largest market share, driven by widespread use in filming, photography, and inspection.

• 2 Kg – 25 Kg: Widely used for surveying, mapping, and agriculture.

• 25 Kg – 150 Kg: Expected to grow at a higher CAGR due to increasing development of eVTOL drones for cargo and passenger transport.

By Technology

• Fully Autonomous

• Semi-Autonomous

• Remote Operated (expected to hold the largest share due to affordability and ease of use)

By System

• Hardware (airframe, propulsion system, payload, others) – largest share

• Software – fastest-growing segment due to rising use of mapping and analytics platforms

By Application

• Filming & Photography

• Mapping & Surveying

• Horticulture & Agriculture

• Inspection & Maintenance

• Delivery & Logistics (fastest-growing)

• Surveillance & Monitoring

• Others

Regional Insights

North America

North America led the market with a value of USD 4.34 billion in 2024, driven by strong adoption of drones and presence of key manufacturers. The U.S. alone is projected to reach USD 14.55 billion by 2030, supported by increasing drone usage in logistics, agriculture, and inspection.

Europe

Europe is witnessing steady growth due to increasing use of drones across Germany, France, and the U.K. for infrastructure inspection, energy, and creative media applications.

Asia Pacific

Asia Pacific is anticipated to record the fastest growth, driven by rising drone manufacturing and supportive government investments in countries such as China and Japan.

Key Industry Developments

• March 2021: DJI launched its First-Person View (FPV) drone for entertainment and media applications.

• September 2022: Drone Fund (Japan) invested USD 40 million in Indian drone manufacturing startups.

• September 2022: Drone Nerds launched DJI Mavic 3 Enterprise for commercial operations.

• February 2022: Zain Group partnered with Saudi Arabia to develop drone technologies.

• October 2021: Fixar partnered with Paras Aerospace to enter the Indian market.

The global market research report delivers a comprehensive analysis of the industry, emphasizing critical aspects such as product types, technology landscape, hardware components, and software systems. It further provides in-depth insights into prevailing market trends, competitive dynamics, industry competition, pricing analysis, current market status, and major industry developments.

Related Reports:

Drone Software Market Size, Share & COVID-19 Impact Analysis

Drone Services Market Size, Share, Russia-Ukraine War Impact Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.